The true value of a Montreal condo isn’t on the price tag; it’s hidden in the syndicate’s financial records and the building’s structural integrity.

- Skyrocketing condo fees are often predictable if you know the specific financial red flags to look for in syndicate documents, as mandated by Quebec’s Bill 16.

- A building’s construction (concrete vs. wood) and its approach to soundproofing are non-negotiable factors that determine your long-term quality of life.

Recommendation: Before making an offer, conduct a “financial forensic” audit of the co-ownership’s health and evaluate the property using a “Lifestyle Score” that goes beyond a generic Walk Score.

For the ambitious urban professional, a downtown Montreal condo represents the pinnacle of a low-maintenance, high-convenience lifestyle. The allure is undeniable: walk to work, vibrant nightlife at your doorstep, and no lawns to mow. But the common advice—”check the condo fees” or “read the documents”—is dangerously superficial. It barely scratches the surface of a market laden with financial traps and quality-of-life compromises that can turn a dream home into a nightmare of special assessments and noisy nights.

Buyers often focus on the mortgage payment and the view, overlooking the critical health of the condo syndicate or the real-world implications of living in a tourist-heavy area. The sticker price is just the beginning of the story. The real deal is found by decoding the details that 40% of new owners miss: the state of the contingency fund, the nuances of the building’s construction, and the subtle but powerful bylaws that can dictate everything from your ability to rent your unit to the future of your investment.

But what if the key wasn’t just finding a good deal, but avoiding a bad one? This guide moves beyond the brochure. We will dive into the structural, financial, and legal forensics required to truly vet a Montreal condo. It’s about learning to spot the red flags in meeting minutes, understanding the acoustic science behind silence, and assessing value based on real-world Montreal living, not just a generic online score. This is your playbook for making a sharp, informed, and value-focused decision.

This article provides an in-depth analysis of the critical factors you must consider before buying a condo in Montreal. Explore the sections below to become a more discerning buyer.

Summary: A Savvy Buyer’s Guide to Vetting Montreal Condos

- Why Your Condo Fees Could Double in 5 Years Without Warning?

- Concrete vs. Wood Structure: Which Condo Type Guarantees Silence?

- Buying a Condo for Airbnb: The Risk of sudden Syndicate Bans

- New Construction or Resale: Which Offers Better Value in 2024?

- How to Furnish a 500 sq. ft. Condo to Maximize Resale Appeal

- The Condo Syndicate Trap: What 40% of New Owners Fail to Check

- Does a High Walk Score Really Increase Your Condo’s Resale Value?

- Old Montreal Real Estate: Is the Prestige Worth the Logistics Nightmare?

Why Your Condo Fees Could Double in 5 Years Without Warning?

The most common shock for new condo owners isn’t a noisy neighbour; it’s a sudden, steep increase in condo fees or a multi-thousand-dollar “special assessment.” These aren’t random events. They are the predictable result of underfunded syndicates finally facing reality, a trend accelerated by Quebec’s Bill 16. This law now mandates that syndicates conduct a contingency fund study to properly budget for future major repairs. For years, many buildings kept fees artificially low, and the bill is now coming due. In fact, market analysis shows an average 40% increase in annual condo fees between 2020 and 2024 alone.

A savvy buyer doesn’t just ask for the current fees; they perform financial forensics on the syndicate’s health. This means meticulously reviewing the minutes of past annual general meetings (AGMs). These documents are a treasure trove of information, revealing discussions about upcoming repairs, cash flow problems, and disputes that signal future costs. Ignoring them is like buying a car without checking its service history. The syndicate’s true health is the single most important factor for your investment’s long-term stability.

Your Financial Forensics Checklist: Key Red Flags in Condo Minutes

- Search for French Keywords: Look for terms like “réparation majeure” (major repair) and “cotisation spéciale” (special assessment) to identify planned or past extra charges.

- Water Infiltration: Note any mention of “infiltrations d’eau,” as water issues are notoriously expensive to resolve and can lead to building-wide costs.

- Contingency Fund Status: Verify if the “étude du fonds de prévoyance” (contingency fund study) has been completed as required by Bill 16. Its absence is a major red flag.

- Funding Debates: Pay close attention to discussions about the “fonds de prévoyance” (contingency fund) to see if the board is actively addressing underfunding or kicking the can down the road.

- Pending Litigation: Check for any mention of legal action (“poursuite judiciaire”) involving the syndicate, which could represent a significant financial liability.

Ultimately, low condo fees can be a trap. A well-managed building with higher, realistic fees is a far safer and more stable investment than one with deceptively low fees that are destined to skyrocket.

Concrete vs. Wood Structure: Which Condo Type Guarantees Silence?

Beyond the financials, the single biggest factor affecting your daily quality of life in a condo is noise. Whether it’s the sound of footsteps from above or conversations from next door, poor sound insulation can ruin the urban living experience. The key differentiator here is the building’s core structural integrity and soundproofing, which largely comes down to two types: concrete construction or wood-frame construction. While many assume concrete is inherently superior, the reality is more nuanced and depends heavily on the quality of the overall assembly.

The National Building Code of Canada sets minimum standards for acoustic separation between units. It specifies an STC 50 minimum for airborne sound (like voices or music) and recommends an IIC 55 for impact noise (like footsteps or dropped objects). However, these are minimums, and a building that just meets code may still be unpleasantly noisy. High-quality construction aims for STC and IIC ratings well into the 60s.

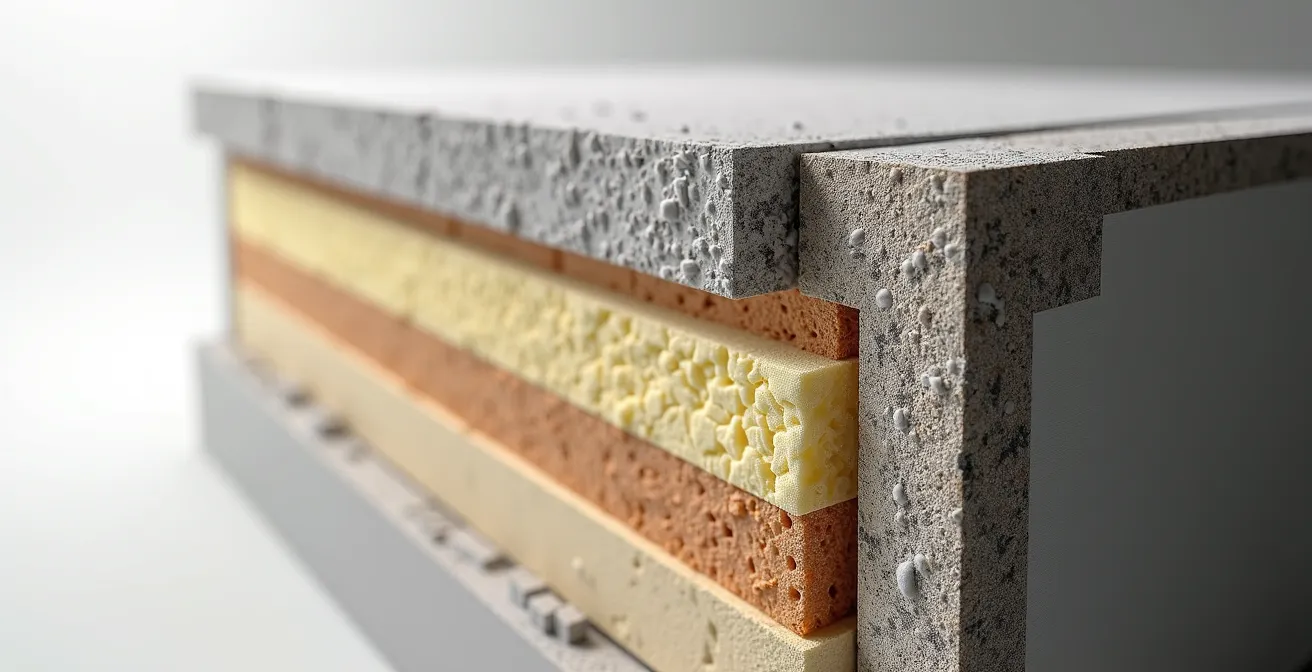

This illustration of a wall’s cross-section shows the different layers involved in soundproofing. Effective noise control isn’t just about the primary structural material (concrete or wood). It’s about the entire system: the density of the material, the presence of acoustic insulation like mineral wool, air gaps that disrupt sound waves, and the use of resilient channels that decouple drywall from the structure. A high-end wood-frame building with excellent acoustic design can outperform a poorly constructed concrete one.

The following table gives a general idea of how different structures perform. Note how the addition of a quality underlayment dramatically improves the performance of a concrete slab, highlighting that the finishings are just as important as the core structure.

| Structure Type | Base IIC Rating | Base STC Rating | Noise Control Quality |

|---|---|---|---|

| 6-inch Concrete Slab | 28-35 IIC | 52-55 STC | Poor impact, good airborne |

| Wood Frame with Drywall | 40-45 IIC | 40-43 STC | Better impact, moderate airborne |

| Concrete + Quality Underlayment | 50-68 IIC | 67+ STC | Excellent for both types |

When visiting a property, ask pointed questions about the STC/IIC ratings and the specific materials used between floors and walls. Don’t just look at the finishes; inquire about what’s behind them.

Buying a Condo for Airbnb: The Risk of sudden Syndicate Bans

The dream of offsetting your mortgage with short-term rental income is a powerful one, but in Montreal, it’s a field of regulatory roulette. Many investors purchase condos with the intention of listing them on platforms like Airbnb or VRBO, only to find their plans derailed by a sudden change in syndicate bylaws or municipal zoning. Relying on the current situation is a high-risk gamble, as the rules can and do change with little warning.

The regulatory landscape is a complex patchwork. First, you need a permit from the Corporation de l’industrie touristique du Québec (CITQ). Second, and more importantly, you must comply with the local borough’s zoning. A building in Ville-Marie might have entirely different rules than one just a few blocks away in the Plateau-Mont-Royal. This hyper-local approach means that what is legal today might be prohibited tomorrow if the syndicate board or the municipality decides to crack down on short-term rentals, often due to complaints from full-time residents.

Case Study: The Evolution of Montreal’s Micro-Zoning

Montreal’s approach to Airbnb regulation varies dramatically by borough. In Ville-Marie, the downtown core, short-term rentals require both a CITQ permit from Quebec AND compliance with local zoning that can change with minimal notice. The Plateau-Mont-Royal has even stricter regulations, while the Sud-Ouest offers more flexibility. This patchwork of rules creates a complex landscape where a legal Airbnb in one borough could be illegal just streets away. An investor who bought in the Plateau assuming city-wide rules would have made a costly mistake.

Before even considering a property for its rental potential, you must thoroughly vet its viability. This includes reviewing the Declaration of Co-ownership for any clauses restricting rentals under 30 days. It’s also critical to check the percentage of non-resident owners; a high number of investor-owners increases the risk of future bans as full-time residents push back against transient traffic. Finally, if the developer still controls the syndicate, be wary: they may permit rentals to attract investors, a policy the first resident-elected board may immediately overturn.

In short, never assume you can operate a short-term rental. Obtain written confirmation from the syndicate, verify municipal zoning for the exact address, and be prepared for the rules to change at any time.

New Construction or Resale: Which Offers Better Value in 2024?

The classic dilemma for buyers: the clean slate of a new build versus the established character of a resale unit. In Montreal’s 2024 market, the answer isn’t straightforward. New constructions offer modern amenities and the appeal of being the first owner, but they come with hidden costs that can quickly erode their perceived value. Resale condos, on the other hand, provide a clearer picture of costs and community but may require updates.

The market continues to show strength. Recent analysis reveals that condo prices increased by 4.8% compared to the previous year, with further growth expected. In this appreciating market, it’s easy to get caught up in the “new and shiny.” However, new builds in Quebec are subject to GST and QST. While rebates exist, they don’t cover the full amount, and the “welcome tax” (property transfer tax) is calculated on the pre-rebate price. These taxes, combined with the initial cost of furnishing a completely empty unit, can add a significant premium over a comparable resale.

Case Study: The Hidden Costs of New Construction

While new condo buyers in Quebec can receive GST and QST rebates, the final price often exceeds resale units once you factor in the non-rebated portion of taxes, welcome tax on the full price, and initial furnishing costs. A $400,000 new condo could end up costing $20,000-30,000 more than its listed price after all taxes and mandatory fees, whereas resale units have these costs already absorbed into the market price from previous owners and do not have GST/QST applied to the sale.

Resale condos offer better price transparency. The fees, taxes, and community dynamics are established. You can review years of syndicate minutes to assess the building’s financial health—a luxury not available with a new build where the syndicate is brand new and the contingency fund is at zero. A resale unit might require a kitchen update, but that’s a predictable cost, unlike a surprise special assessment in a new building that underestimated its budget.

Ultimately, value in 2024 is less about age and more about transparency. A well-maintained resale unit in a financially healthy building often presents a more secure and predictable investment than a brand-new condo with an unknown future.

How to Furnish a 500 sq. ft. Condo to Maximize Resale Appeal

In the world of compact downtown condos, space is the ultimate luxury. How you furnish a 500-square-foot unit directly impacts not only your quality of life but also its appeal to future buyers. The goal is to create a space that feels open, functional, and sophisticated. It’s about demonstrating potential and solving storage problems before they arise. A well-furnished small condo can command a higher price and sell faster than an empty or poorly staged one.

The key is to invest in multi-functional furniture and clever built-ins. Think of a Murphy bed that folds away to reveal a desk, an ottoman with hidden storage, or a dining table that expands. These pieces don’t just save space; they provide permanent solutions that add tangible value to the property. When it comes to style, the “Griffintown Uniform” is a safe and effective bet: a neutral palette of greys, whites, and natural wood tones that appeals to the broad demographic of young professionals who are the primary buyers for these units.

This aesthetic, as seen in many modern Montreal condos, emphasizes clean lines and an uncluttered feel. The focus is on making the space feel larger than it is. Using mirrors to reflect light, choosing furniture with exposed legs to create a sense of openness, and ensuring every piece serves a purpose are all critical strategies. The balcony, often an overlooked space, should be treated as a “second living room” with weather-resistant furniture and outdoor flooring, effectively extending the usable living area.

Your Action Plan for Furnishing a Small Condo

- Invest in Duality: Purchase multi-functional furniture from local Montreal-friendly retailers like Structube or EQ3, where pieces like sofa beds and storage coffee tables are staples.

- Go Vertical with Built-ins: Install permanent solutions like Murphy beds with integrated desks or floor-to-ceiling shelving to maximize vertical space and add direct value.

- Embrace the Neutral Palette: Stick to a neutral grey and white color scheme. It’s a proven look that has wide appeal in the Montreal market and makes small spaces feel larger.

- Conquer the Entryway: Create smart, slim storage solutions in the entrance for coats, shoes, and keys to prevent this crucial area from becoming a clutter zone.

- Activate the Balcony: Transform the balcony into a functional outdoor room with comfortable seating and affordable IKEA deck tiles.

Consider which furniture could be included in the sale. High-quality, custom-fit built-ins are a major selling point that can justify a higher asking price and set your unit apart from the competition.

The Condo Syndicate Trap: What 40% of New Owners Fail to Check

Beyond the visible amenities and the monthly fees lies the most critical and most overlooked aspect of a condo purchase: the health of the co-ownership syndicate. Many buyers, especially first-timers, are so focused on their own mortgage that they fail to properly investigate the collective financial obligations they are about to inherit. This oversight is a trap. You are not just buying your unit; you are buying into a small business with shared assets and, more importantly, shared liabilities.

A key area of neglect is the self-insurance fund. Since the implementation of Quebec’s Bill 141, syndicates are legally required to hold a fund to cover the insurance deductible in case of a major claim. This is separate from the regular contingency fund for repairs. With deductibles for common issues like water damage often reaching tens of thousands of dollars, an underfunded self-insurance fund is a ticking time bomb. According to legal experts in Quebec real estate, it is now mandatory to have a self-insurance fund equal to the highest deductible, which can easily be $25,000, $50,000, or more.

If a major incident occurs and this fund is inadequate, the syndicate has no choice but to levy a special assessment on all co-owners to cover the shortfall. This means you could suddenly face a bill for thousands of dollars, completely separate from your mortgage and regular condo fees. This is why a thorough review of the syndicate’s insurance policy and the status of its various funds is not optional—it’s essential financial self-defense. You must verify that the syndicate is compliant with all current legislation and is not just hoping for the best.

Before you sign, demand to see the building’s insurance policy, the minutes from the last AGM discussing the self-insurance fund, and a recent financial statement. If the information is not readily available or the real estate agent is dismissive of your request, consider it a serious red flag.

Key Takeaways

- Financial Forensics are Mandatory: Don’t just accept the current condo fees. Scrutinize AGM minutes for red flags like “cotisation spéciale” and verify the status of the contingency fund study required by Bill 16.

- Structure Defines Serenity: The building’s construction (concrete vs. wood) and its acoustic assembly (STC/IIC ratings) are critical for your long-term peace and quiet. Ask for the technical specifications.

- Go Beyond Walk Score: A high Walk Score is standard downtown. Create your own “Montreal Lifestyle Score” by evaluating proximity to BIXI stations, quality cafés, the SAQ, and REM/Metro lines to assess true convenience.

Does a High Walk Score Really Increase Your Condo’s Resale Value?

For years, the real estate mantra for urban properties has been “Walk Score.” It’s a simple, appealing metric that promises a car-free, convenient lifestyle. While a good Walk Score is certainly a prerequisite for any downtown condo, its ability to predict or increase resale value in a market like Montreal is highly overestimated. Once you reach a certain threshold of walkability, other, more nuanced factors become far more important in determining a property’s true worth.

In most of Montreal’s central boroughs, a Walk Score of 90+ (“Walker’s Paradise”) is the norm, not the exception. When nearly every property on the market boasts a near-perfect score, the metric loses its power as a differentiator. The real value is found in what the Walk Score *doesn’t* measure: the quality of the immediate environment. Is the proximity to a major festival zone a perk or a source of unbearable noise for three months a year? Is the nearby metro station on a key line like the Orange Line, or a less convenient one? These are the questions a savvy buyer asks.

Case Study: Walk Score vs. Real-World Value

An analysis of Montreal condo prices reveals a telling story. Consider two comparable one-bedroom condos: one in the Quartier des Spectacles and one in a quiet part of Westmount. Both have Walk Scores exceeding 90. Yet, the Westmount unit can command a price $100,000 higher. Why? The Walk Score ignores crucial “lifestyle compromise” factors like the persistent noise from summer festivals, the character of the neighborhood, and the overall prestige of the address. This demonstrates that once basic walkability is established, other factors drive value.

Instead of relying on a generic algorithm, create your own “Montreal Lifestyle Score.” This personalized metric reflects what truly matters for living in the city.

How to Create Your Own ‘Montreal Lifestyle Score’

- BIXI Bike Proximity: Check the distance to the nearest BIXI bike-sharing stations. This is an essential part of Montreal’s summer transport network.

- Quality Café & Bakery Access: Evaluate the walking distance to a *quality* local café and bakery, a cornerstone of Montreal’s neighborhood culture.

- SAQ Convenience: Measure the walking time to the nearest SAQ (Quebec’s liquor store). This is a practical consideration for anyone who entertains.

- Key Transit Lines: Assess access to the REM or major Metro lines (Orange, Green). Not all transit stops offer the same level of city-wide connectivity.

- Festival Zone Impact: Calculate the distance from major summer festival zones. This can be a significant source of noise and disruption.

A high Walk Score gets you in the game, but a high personalized Lifestyle Score is what makes a property a long-term win.

Old Montreal Real Estate: Is the Prestige Worth the Logistics Nightmare?

Owning a piece of Old Montreal is a romantic notion. The historic cobblestone streets, 19th-century architecture, and European ambiance offer a lifestyle unlike any other in North America. However, behind the postcard-perfect facade lies a daily reality of logistical challenges that can quickly outweigh the prestige. For a full-time resident, the very things that make the area a world-class tourist destination can become significant sources of frustration.

The most immediate challenge is accessibility. During the high season, from May to October, the streets are thronged with tourists, walking tours, and horse-drawn carriages, making a simple trip to the grocery store a major undertaking. Parking is another significant hurdle. Residential permits are nearly impossible to obtain, forcing most residents into private lots where costs reflect the scarcity. It’s not uncommon to pay over $300 per month for a parking spot, a substantial hidden cost of ownership. During major events like the Grand Prix or summer festivals, many streets are closed entirely, effectively trapping residents or cutting them off from their homes.

The living experience in Old Montreal is a tale of two cities, dictated entirely by the tourist season. The table below outlines this stark contrast.

| Season | Living Conditions | Key Challenges | Benefits |

|---|---|---|---|

| High Season (May-Oct) | Extremely touristy | Inaccessible streets, tour groups, crowded restaurants | Vibrant atmosphere, events |

| Low Season (Nov-Apr) | Quiet and peaceful | Limited services, some closures | Magical winter atmosphere, authentic local experience |

| Festival Periods | Chaotic | Street closures, extreme noise, parking impossible | World-class entertainment at doorstep |

For those seeking a vibrant, if sometimes chaotic, lifestyle and who can embrace a car-free existence, Old Montreal can be magical. But for the urban professional who values efficiency and predictability, the daily logistical hurdles might make a modern condo in a neighbouring area like Griffintown a far more practical and valuable choice.